Introduction

Navigating the complexities of short-term disability due to anxiety can feel overwhelming, especially as mental health challenges increasingly affect individuals in the workforce. This article explores ten essential insights that not only clarify the intricacies of short-term disability insurance but also highlight the vital support available for those grappling with anxiety disorders. Many individuals find themselves asking how to secure the assistance they need. Understanding the eligibility requirements, application processes, and financial implications is crucial. Have you ever felt uncertain about where to turn for help during these challenging times? Let's delve into these insights together, ensuring you feel supported and informed.

The Emerald Couch: Tailored Psychotherapy for Anxiety-Related Short-Term Disability

At The Emerald Couch, we understand that life can sometimes feel overwhelming, especially when facing short term disability for anxiety. Have you ever felt like your worries are holding you back? You're not alone. Research shows that many individuals experience unease that can disrupt their daily lives. Our caring and comprehensive approach to psychotherapy is specifically designed to support you during these temporary struggles related to short term disability for anxiety.

Our therapists employ trauma-informed care, creating a safe and nurturing environment where you can explore your mental health needs. This customized method not only helps you manage stress but also equips you with essential resources to navigate the complexities of short term disability for anxiety. We believe that personal growth and resilience are vital for reclaiming your life and enhancing your work capabilities.

As mental health specialists emphasize, holistic methods can significantly improve treatment outcomes for stress. By focusing on your unique journey, we promote a sense of empowerment and well-being. Together, we can work towards a brighter future where you feel understood and supported. If you're ready to take the next step towards healing, we invite you to reach out and discover how we can help.

Understanding Short-Term Disability Insurance: Key Definitions and Concepts

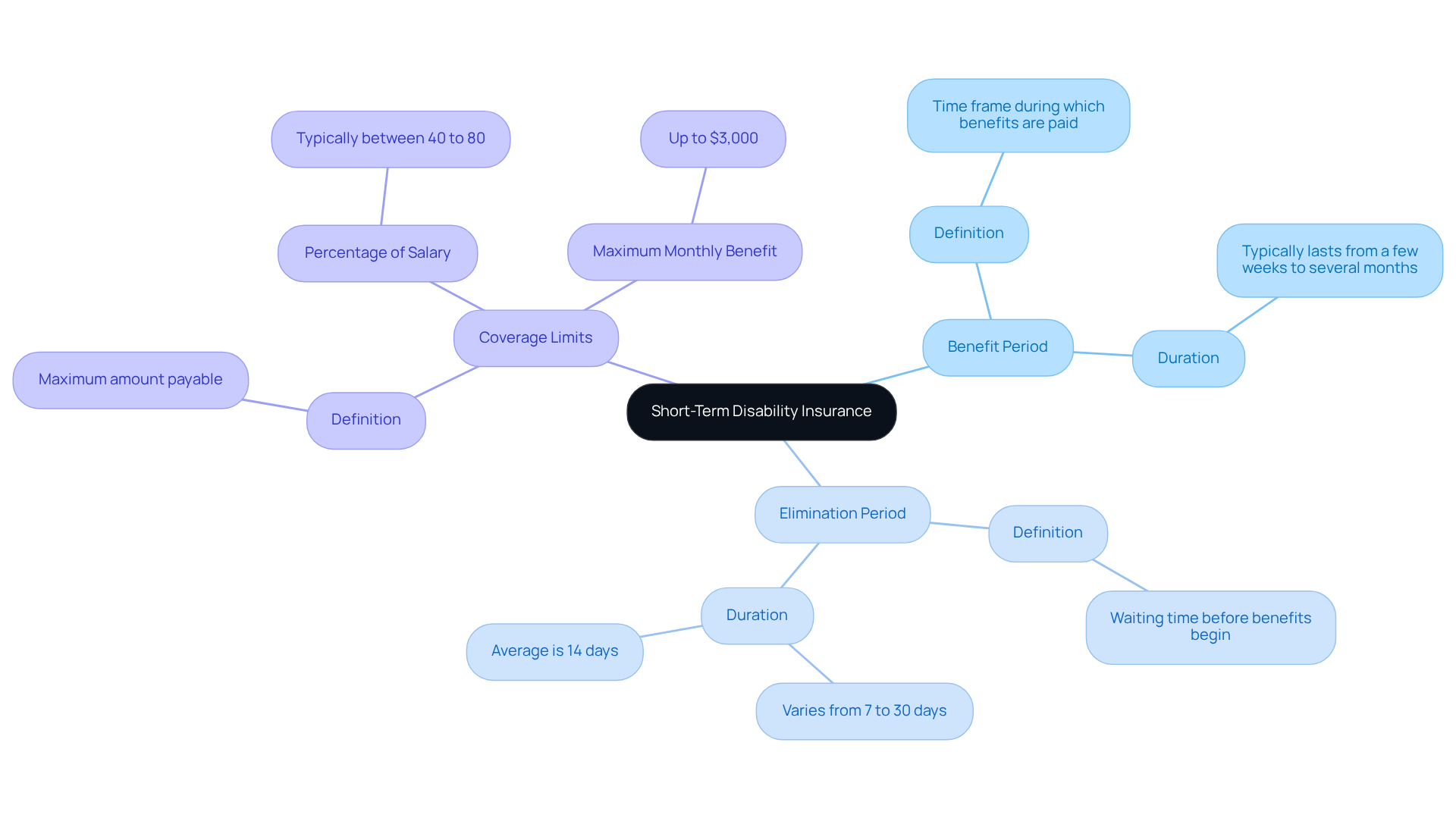

Short-term disability for anxiety is a crucial financial resource for those who find themselves unable to work due to medical conditions. It's important to grasp some key terms to navigate this type of insurance effectively:

- Benefit Period: This is the time frame during which benefits are paid, typically lasting from a few weeks to several months, depending on the policy.

- Elimination Period: This refers to the waiting time before benefits begin, which can vary significantly between policies, often ranging from 7 to 30 days.

- Coverage Limits: These limits indicate the maximum amount payable, usually expressed as a percentage of the employee's salary, often between 40% to 80%.

Understanding these concepts is vital for securing short term disability for anxiety, which you may need during recovery from stress-related disorders. Have you ever felt overwhelmed by the thought of navigating insurance details? Insights from insurance professionals highlight the importance of carefully reviewing policy specifics to understand how these elements interact and influence your overall coverage.

With more than 25% of today’s 20-year-olds expected to face limitations before retirement, understanding options like short term disability for anxiety is increasingly important for managing mental health. Remember, seeking help is a sign of strength, and understanding your options can be the first step towards healing.

Eligibility Requirements for Short-Term Disability Due to Anxiety Disorders

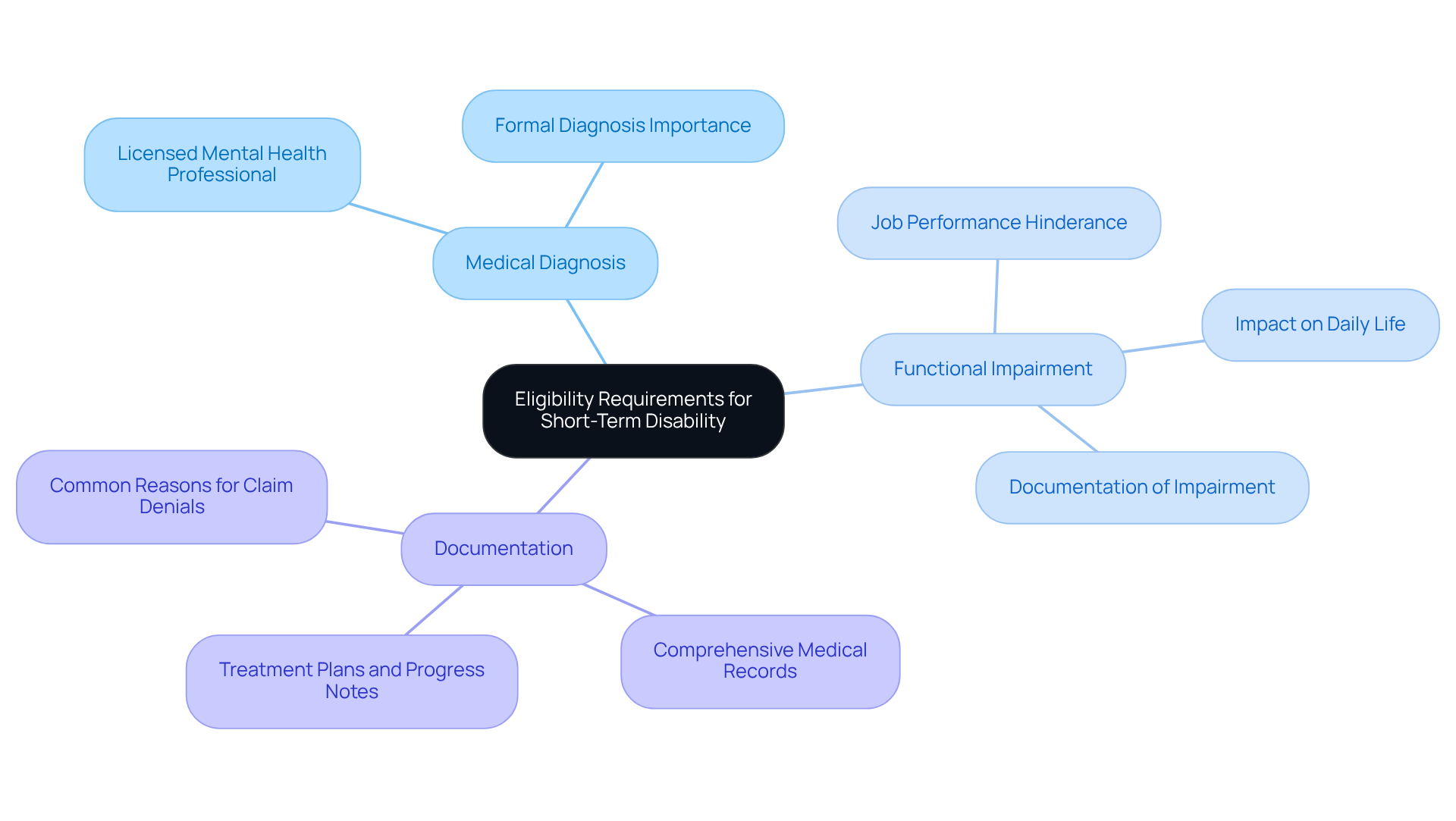

To qualify for short-term disability benefits due to anxiety disorders, it’s essential to understand a few key criteria that can help you navigate this process with confidence:

- Medical Diagnosis: First and foremost, a licensed mental health professional needs to provide a formal diagnosis of your anxiety disorder. This diagnosis is not just a formality; it’s a vital step that establishes the legitimacy of your claim and helps you feel validated in your experience.

- Functional Impairment: Next, it’s important to recognize how the disorder affects your daily life. The anxiety disorder must significantly hinder your ability to qualify for short term disability for anxiety, affecting your performance of essential job functions. Documenting this impairment clearly can make a world of difference in demonstrating the impact on your work performance.

- Documentation: Lastly, comprehensive medical records are crucial. This includes treatment plans and progress notes that support your claim. Remember, inadequate documentation is a common reason for claim denials, and many claims are rejected due to insufficient medical evidence. Taking the time to gather this information can be a key factor in your success.

Understanding these requirements is vital for you to prepare your application effectively. By presenting a compelling argument for your temporary assistance, you’re taking an important step towards healing and support. Have you ever felt overwhelmed by the process? Remember, you’re not alone in this journey, and seeking help can make all the difference.

How to Apply for Short-Term Disability Benefits for Anxiety

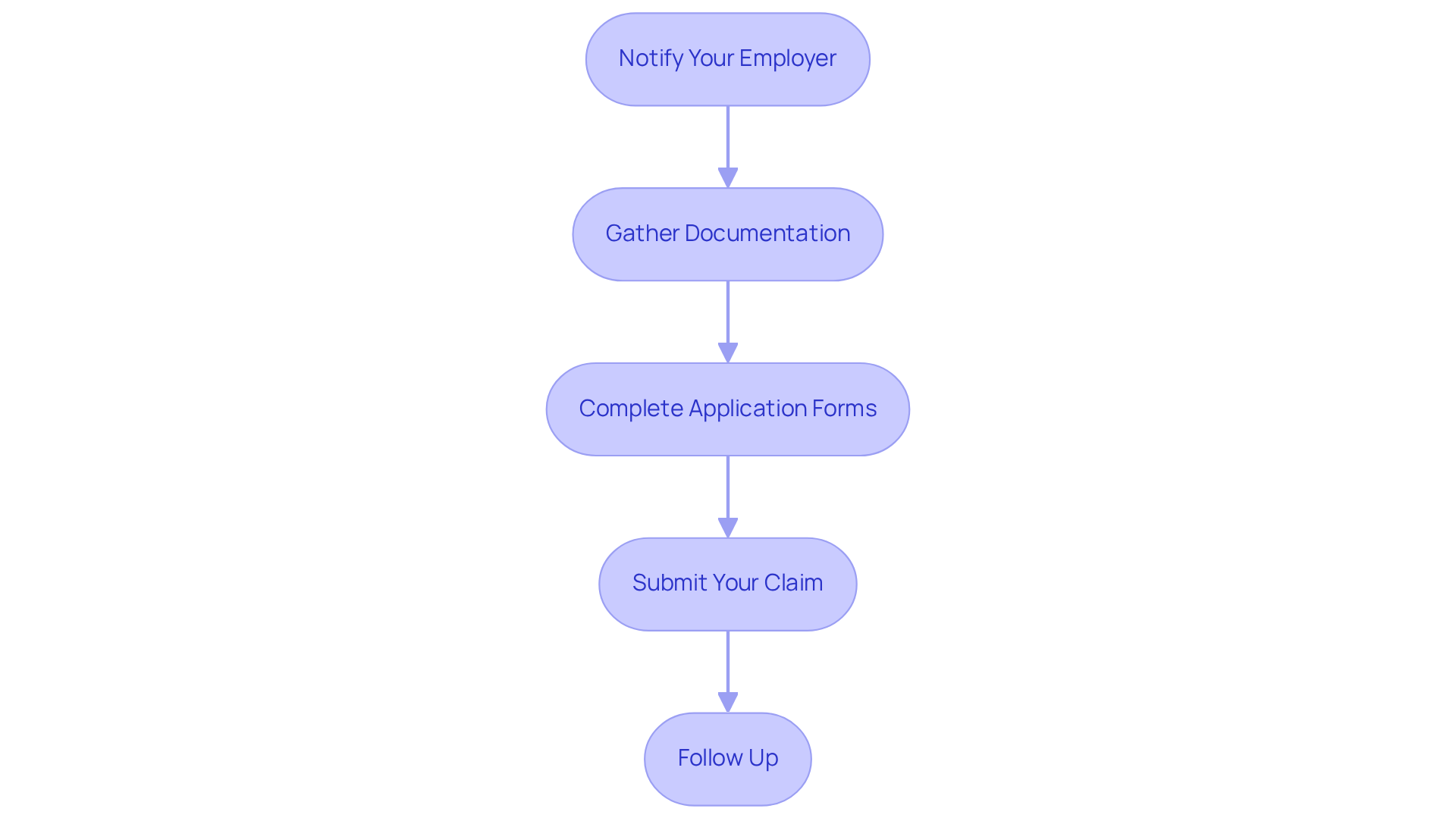

Applying for short-term disability benefits due to anxiety can feel overwhelming, but with careful preparation and a few specific steps, you can navigate this process with confidence and support:

-

Notify Your Employer: Start by reaching out to your HR department or supervisor about your condition and your intention to apply for assistance. This initial communication is crucial; it lays the groundwork for your application. Have you ever felt anxious about sharing your struggles? Remember, notifying your employer promptly can help ensure that your claim is processed smoothly and efficiently.

-

Gather Documentation: Collect all necessary documentation, such as medical records, treatment plans, and notes from your healthcare provider. Thorough documentation is essential, as claims often hinge on the quality and completeness of the medical evidence provided. Insufficient medical evidence is a common reason for denial of claims, so be diligent in gathering comprehensive records. Think of this as building a strong foundation for your claim.

-

Complete Application Forms: Take your time to accurately fill out the required application forms provided by your employer or insurance company. Ensure that all information is complete and truthful, as discrepancies can lead to delays or denials. Remember, submitting your claim within 9 days of the onset of your condition is essential to avoid processing delays. It’s okay to ask for help if you need it-you're not alone in this.

-

Submit Your Claim: Once you’ve completed your application, send it along with the supporting documents to the designated department. Keep copies of everything submitted for your records; this can be helpful in case of follow-up inquiries. Keeping detailed records of your submission can aid in tracking your claim's progress. It’s a small step that can make a big difference.

-

Follow Up: Regularly check the status of your claim. Be proactive in communicating with the insurance company or HR department, and be prepared to provide additional information if requested. Staying engaged in the process can help expedite your claim and ensure that you meet all necessary requirements. As noted by legal experts, active participation in the claims process is vital for a successful outcome. Have you considered how staying involved can empower you during this time?

By following these steps, you can successfully manage the intricacies of applying for short term disability for anxiety. Remember, seeking support during your recovery is a sign of strength, and you deserve the help you need.

Duration of Short-Term Disability Benefits for Anxiety: What to Expect

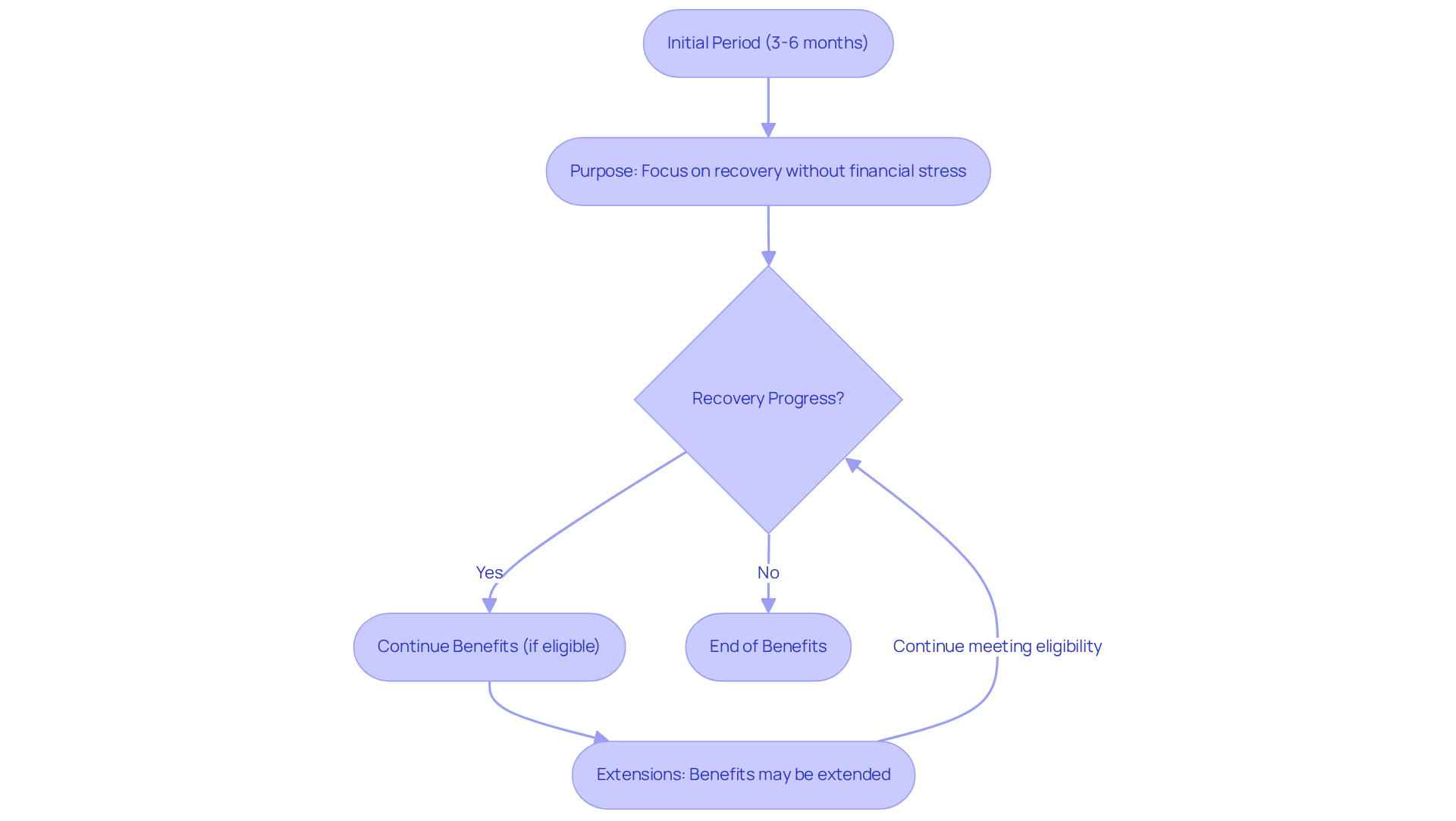

The length of temporary support for stress-related issues typically ranges from a few weeks to six months. This duration can vary based on specific policies and the severity of the condition. Understanding this can be crucial for your journey towards healing. Most plans offer benefits structured in a way that nurtures recovery:

- Initial Period: Covering the first 3-6 months of treatment, this phase allows you to focus on your recovery without the added burden of financial stress. During this time, many find it essential to engage in therapeutic practices that promote healing. Have you ever felt overwhelmed by your past? This is a time to prioritize your well-being.

- Extensions: If your recovery takes longer than expected, benefits may be extended, provided you continue to meet eligibility criteria and submit updated medical documentation. This extension is vital for those navigating a longer healing process, offering continued financial support as you work towards stability.

Understanding these timelines is essential for effective planning and recovery. Statistics reveal that many individuals facing mental health challenges, such as anxiety, often require short term disability for anxiety to extend their assistance. This highlights the importance of proactive communication with healthcare providers and insurance representatives. As we explore this further, remember that you are not alone in this journey. Seeking help is a courageous step towards healing.

Financial Benefits: How Much Can You Receive from Short-Term Disability for Anxiety?

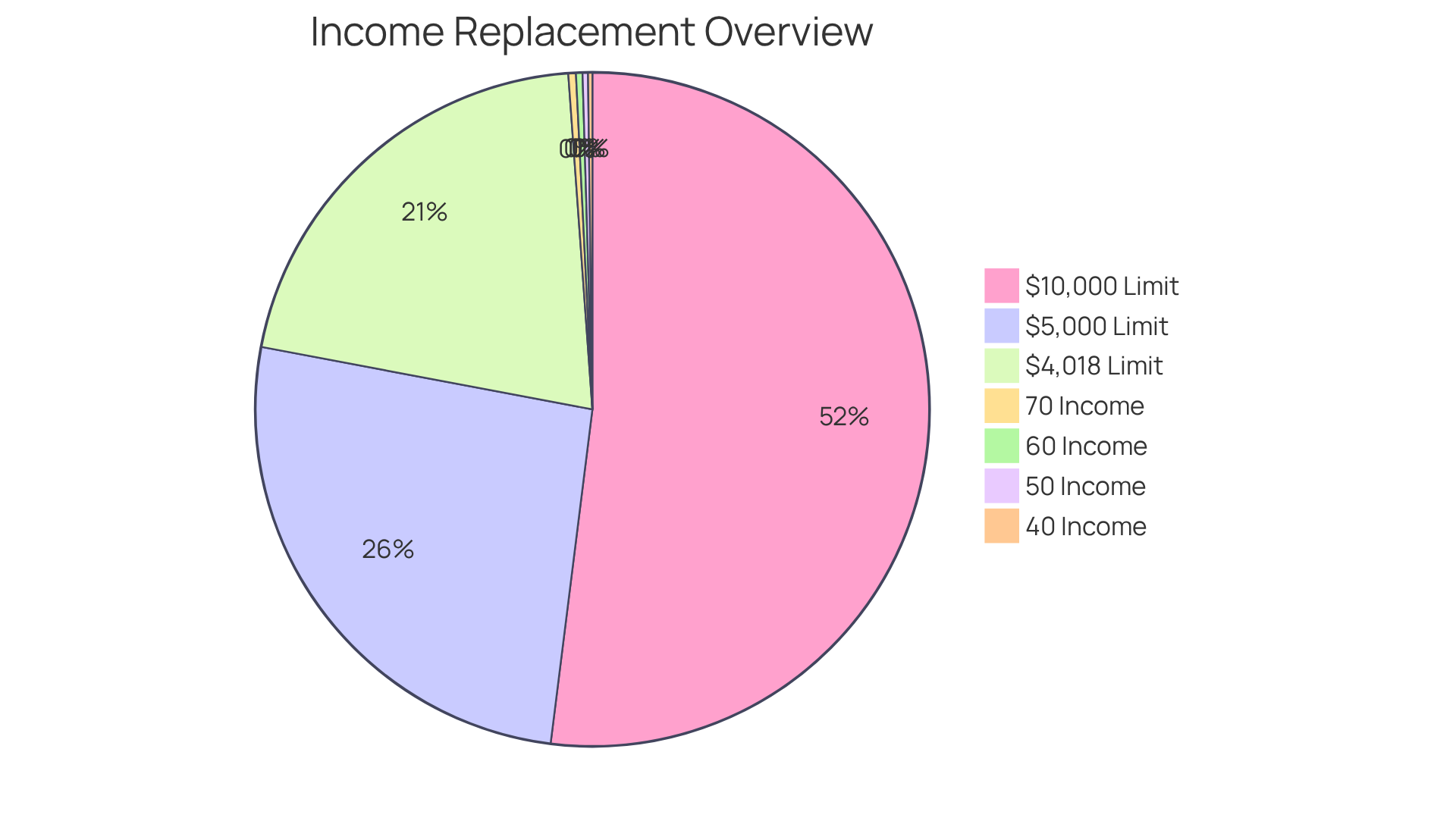

Short term disability for anxiety can significantly ease financial stress by replacing a portion of your income, typically between 40% and 70%. This percentage reflects the common structure of many policies, designed to provide essential support during recovery. Understanding your policy's specifics is crucial, especially since short term disability for anxiety often hovers around the 40% benchmark.

-

Weekly Benefits: Payments are usually distributed weekly and are based on your earnings before the onset of your condition. This alignment helps maintain your standard of living, ensuring that the financial assistance closely mirrors your usual income.

-

Maximum Limits: It's important to recognize that many policies impose caps on total payouts, often ranging from $5,000 to $10,000 per month. For 2025, the maximum assistance for impairment is $4,018 per month. These limits can significantly affect the overall financial support you receive, particularly if you have higher earnings.

-

Tax Implications: The tax status of temporary incapacity payments can vary based on how premiums are paid. If premiums were paid with pre-tax dollars, the amounts received may be taxable. Conversely, those paid with post-tax dollars are generally non-taxable. Understanding these financial nuances is vital for effective planning during your recovery period.

By being aware of these elements, you can navigate your financial situation more effectively while managing stress and pursuing recovery. Have you ever felt overwhelmed by your financial concerns? Remember, seeking support can make a world of difference.

Extending Short-Term Disability Benefits: Options for Anxiety Sufferers

If you find that your anxiety symptoms linger beyond the initial short-term disability period, know that there are compassionate options available to extend your benefits:

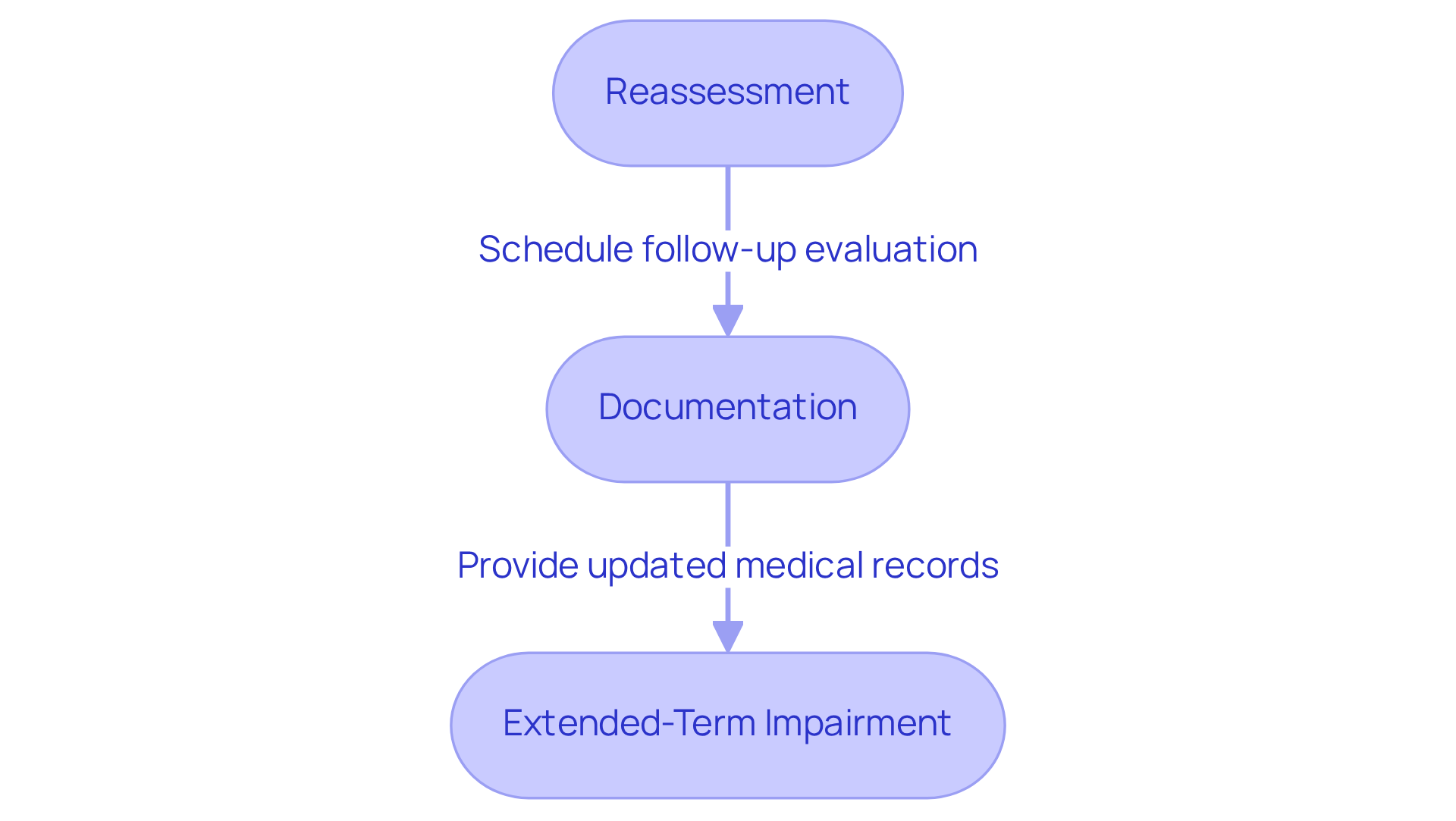

- Reassessment: Have you considered scheduling a follow-up evaluation with your healthcare provider? This step can help assess your ongoing needs and treatment progress. At The Emerald Couch, we believe in collaborative custom treatment planning, ensuring that your plan is tailored to your unique goals and what success looks like for you.

- Documentation: It’s important to provide updated medical documentation to your employer or insurance provider to support your request for an extension. Our team is here to assist you in understanding what documentation may be necessary based on your personalized treatment plan.

- Extended-Term Impairment: If your condition remains serious, think about applying for extended-term support, which may offer additional financial assistance. Understanding these options, including short term disability for anxiety, is crucial for ensuring continued care and financial stability. At The Emerald Couch, we work closely with you to set achievable goals and regularly check in on your progress, helping you navigate the complexities of your mental health journey.

Short-Term vs. Long-Term Disability: Understanding the Differences for Anxiety

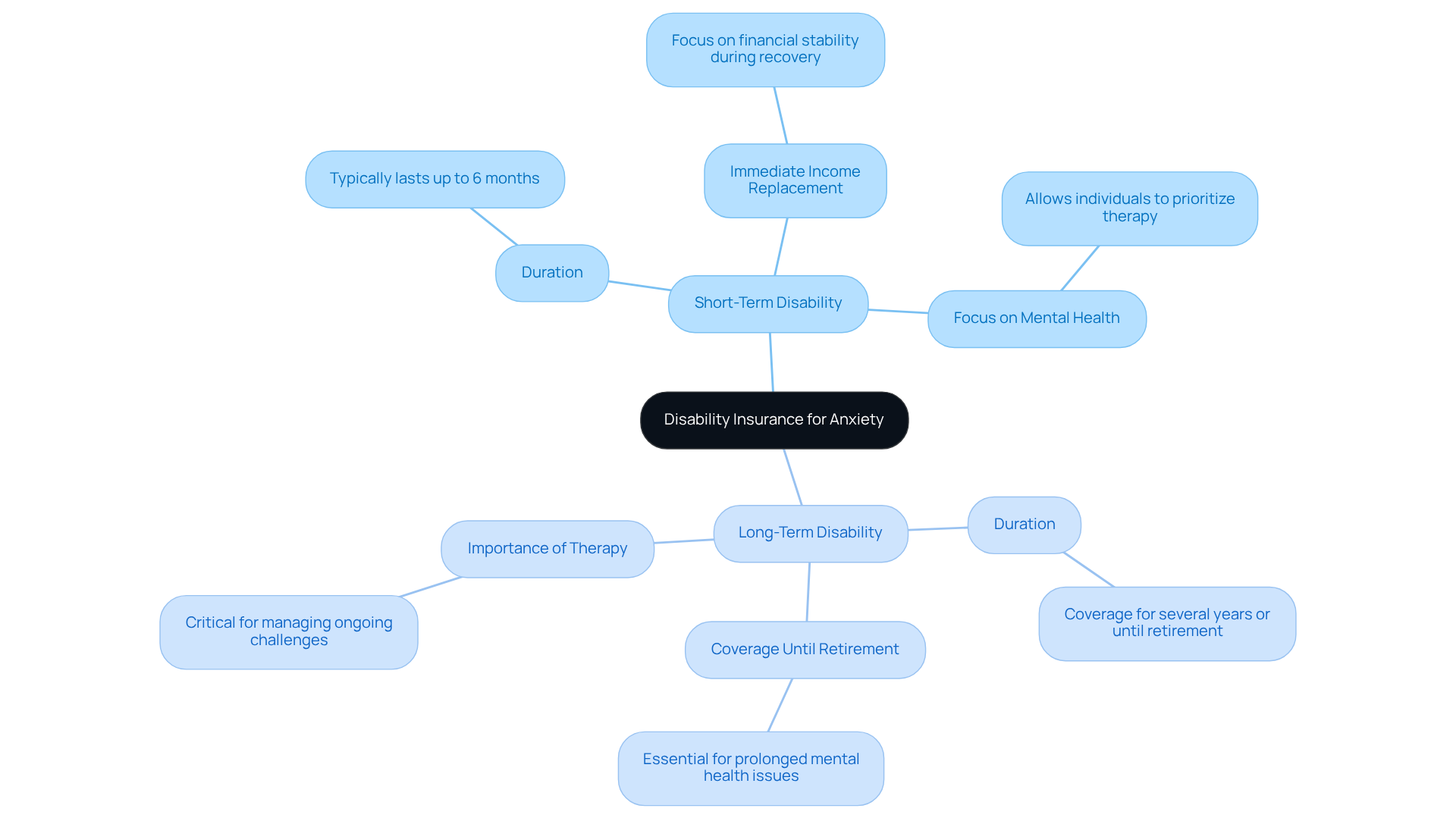

Short-term disability for anxiety and long-term disability insurance play unique yet complementary roles in supporting individuals who are grappling with anxiety, especially high achievers facing burnout and trauma.

This coverage, known as short term disability for anxiety, typically lasts up to six months and offers immediate income replacement for temporary conditions. It allows individuals to focus on their mental health without the added stress of financial burdens. Have you ever felt overwhelmed by your past? At The Emerald Couch, we understand that overachievers often struggle to prioritize their own needs. Our specialized psychotherapy services can help you slow down and become more present during this critical time.

- Long-Term Disability: Once short-term benefits are exhausted, long-term disability can provide coverage for several years or until retirement age, depending on the policy. This insurance is vital for those whose distress significantly impairs their ability to work over an extended period. As we explore this further, we emphasize the importance of therapy in addressing these persistent challenges, assisting clients in managing their trauma and stress effectively.

Understanding these differences is crucial for clients navigating their options. People may shift from temporary to prolonged impairment if their worry continues beyond the initial recovery stage. Insurance experts highlight that temporary incapacity serves as a safety net for immediate needs, while extended incapacity offers a more comprehensive solution for ongoing issues.

Clients often share varied experiences with these insurance types. For instance, one client effectively utilized short term disability for anxiety to cope with severe stress symptoms, later seeking long-term coverage when their condition became more enduring. This underscores the importance of being informed about the duration and scope of each type of insurance, enabling proactive decisions regarding mental health support. At The Emerald Couch, we are here to guide you through this journey, offering personalized treatment plans and flexible appointment options, including virtual consultations, to meet your needs.

What Short-Term Disability Does Not Cover: Myths and Realities for Anxiety

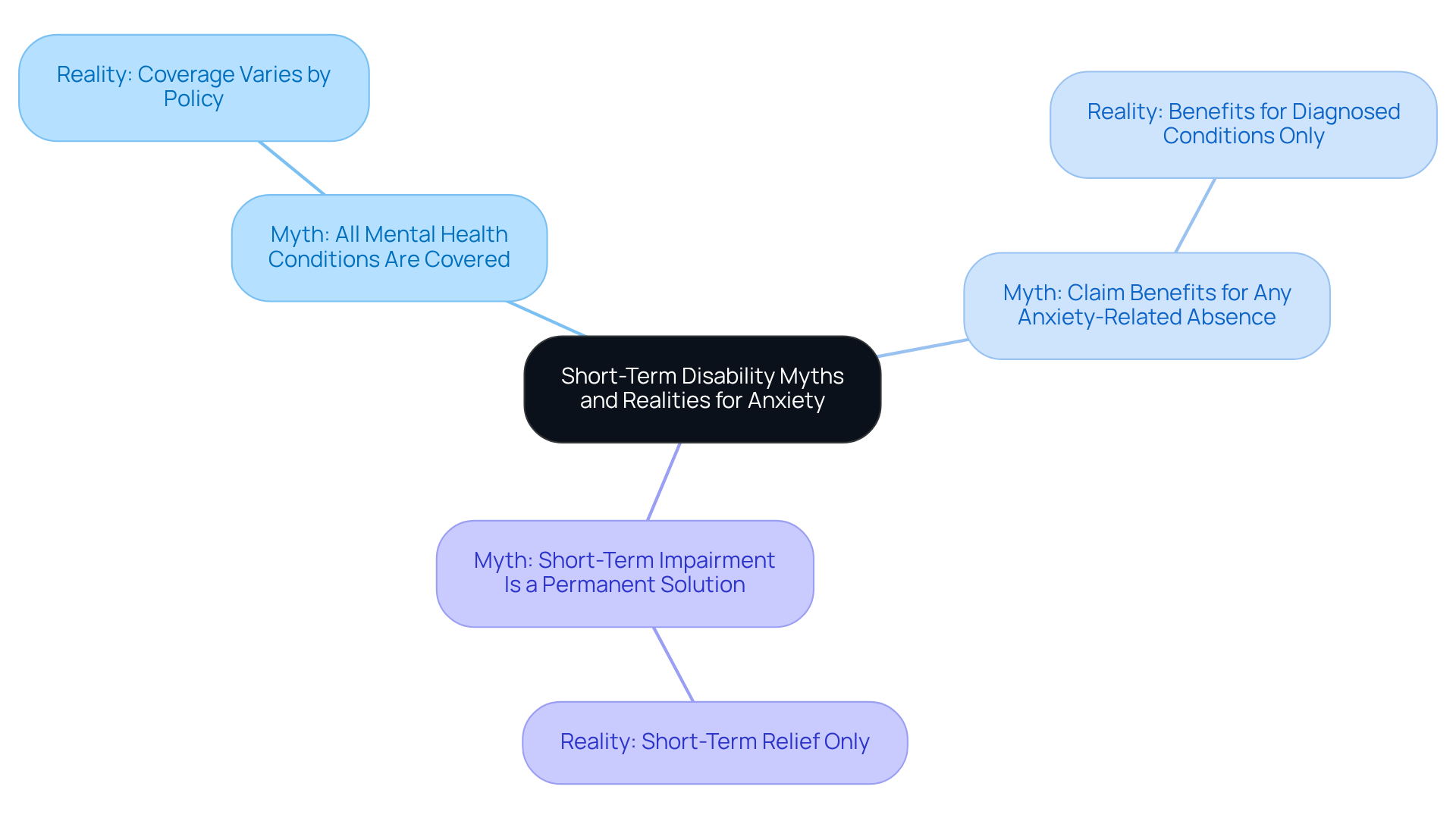

Many myths surround what short-term disability covers for anxiety, leading to confusion among those seeking help:

-

Myth: All mental health conditions are covered.

Reality: Coverage varies significantly by policy; many exclude specific conditions or require detailed documentation to qualify. -

Myth: You can claim benefits for any anxiety-related absence.

Reality: Benefits are generally available only for diagnosed conditions that substantially impair work performance, such as short-term disability for anxiety, not for general anxiety or stress. -

Myth: Short-term impairment is a permanent solution.

Reality: This benefit is aimed at short-term relief; individuals may need to shift to long-term assistance for continued support.

Understanding these realities is crucial for clients navigating their claims successfully. Have you ever felt overwhelmed by the complexities of your situation? Mental health professionals emphasize that misconceptions can lead to frustration and hinder access to necessary support. For instance, many policies do not provide coverage for short-term disability for anxiety unless the condition significantly disrupts daily functioning. This highlights the importance of clear documentation and a thorough understanding of one’s rights. As one specialist observed, "Assisting individuals with challenges means genuinely comprehending their distinct experiences." This insight underscores the need for accurate information when addressing claims related to disabilities.

As we explore this further, remember that seeking help is a sign of strength. You deserve the support you need to navigate these challenges.

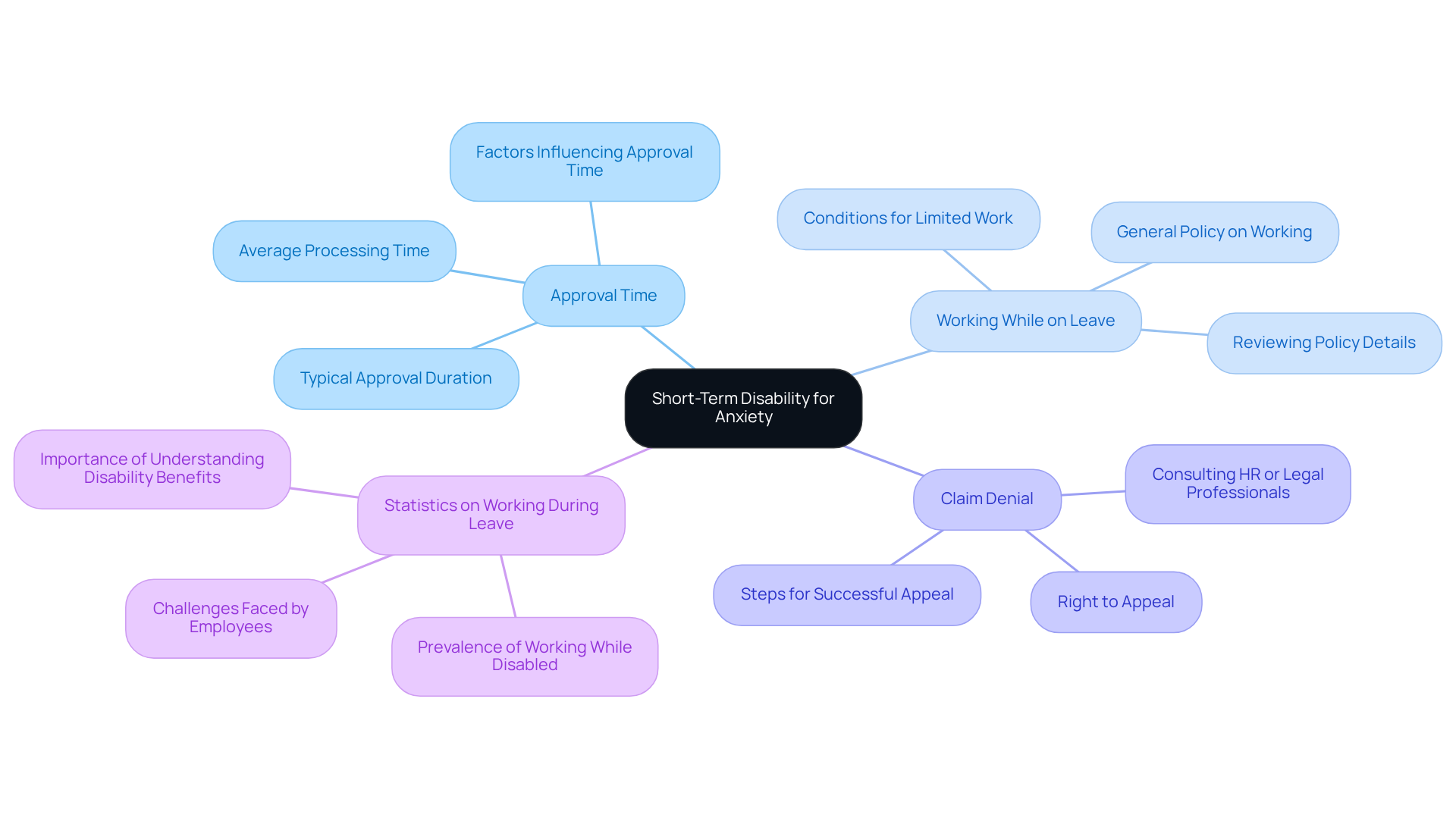

Frequently Asked Questions About Short-Term Disability for Anxiety

Here are some frequently asked questions regarding short-term disability for anxiety:

-

Q: How long does it take to get approved?

A: Approval times for short-term disability claims can vary significantly, typically ranging from a few days to several weeks. Factors influencing this timeline include the completeness of your application and the specific requirements of your insurance provider. On average, the processing time can take anywhere from three to five months, especially if additional documentation is needed. -

Q: Can I work while on temporary leave?

A: Generally, individuals receiving short-term disability benefits are not permitted to work, as the primary purpose of these benefits is to allow for recovery from mental health issues. However, some policies may allow for limited work under specific conditions. It’s essential to review your policy details to understand your options. -

Q: What if my claim is denied?

A: If your claim is denied, remember that you have the right to appeal the decision. It’s wise to consult with your HR department or a legal professional who specializes in disability claims. They can guide you through the appeals process, helping you understand your rights and the necessary steps to improve your chances of a successful appeal. -

Q: What are the statistics on working while on temporary leave for mental health concerns?

A: Approximately 1 in 4 employees report working despite experiencing stress, anxiety, or depression. This highlights the challenges many face in balancing work and mental health recovery. Understanding the implications of short-term disability for anxiety benefits is crucial for navigating this journey.

These insights can empower clients to navigate their claims with greater confidence and clarity. Have you ever felt overwhelmed by your past? Seeking support can be a vital step towards healing.

Conclusion

Navigating the complexities of short-term disability for anxiety can feel overwhelming, but understanding its intricacies is essential for those seeking support. This article has highlighted vital insights, from definitions and eligibility requirements to the application process and financial benefits. Recognizing the importance of tailored psychotherapy, comprehensive documentation, and proactive communication can empower you as you seek the assistance you deserve.

Key points discussed include:

- The significance of obtaining a formal diagnosis

- The necessity of thorough documentation

- The potential financial relief that short-term disability benefits can provide

Have you ever felt uncertain about what coverage entails? This article also addressed common misconceptions surrounding coverage and emphasized the need for clarity when pursuing claims. These insights aim to demystify the process and encourage you to take informed steps toward recovery.

Ultimately, seeking help for anxiety-related challenges is not just a sign of strength; it’s a crucial step toward reclaiming your life and well-being. As the landscape of mental health support continues to evolve, staying informed about options like short-term disability for anxiety can pave the way for healing and resilience. Embrace this journey of understanding, and know that support is available to guide you through this process.

Frequently Asked Questions

What is The Emerald Couch and how does it support individuals with anxiety-related short-term disability?

The Emerald Couch provides tailored psychotherapy specifically designed to support individuals facing short-term disability due to anxiety. Their caring approach focuses on trauma-informed care, creating a safe environment to explore mental health needs and manage stress.

What therapeutic methods does The Emerald Couch employ?

The therapists at The Emerald Couch use a customized method that incorporates trauma-informed care, helping clients manage stress and providing essential resources for navigating short-term disability related to anxiety.

What is short-term disability insurance and why is it important for anxiety disorders?

Short-term disability insurance is a financial resource for individuals unable to work due to medical conditions, including anxiety disorders. It provides benefits during recovery, making it crucial for those facing such challenges.

What are key terms to understand when navigating short-term disability insurance?

Important terms include: - Benefit Period: The duration during which benefits are paid, typically lasting from a few weeks to several months. - Elimination Period: The waiting time before benefits begin, ranging from 7 to 30 days. - Coverage Limits: The maximum amount payable, usually expressed as a percentage of the employee's salary, often between 40% to 80%.

What are the eligibility requirements for short-term disability benefits due to anxiety disorders?

To qualify for benefits, you need: - A formal diagnosis of your anxiety disorder from a licensed mental health professional. - Documentation showing how the disorder significantly impairs your daily life and job performance. - Comprehensive medical records, including treatment plans and progress notes to support your claim.

Why is documentation important for short-term disability claims?

Comprehensive documentation is crucial because inadequate medical records are a common reason for claim denials. Properly documenting your condition and its impact can significantly improve your chances of a successful claim.

How can individuals feel empowered in the process of seeking help for anxiety-related short-term disability?

Understanding the insurance options and eligibility requirements, as well as seeking support from professionals, can empower individuals. It is important to recognize that seeking help is a sign of strength and a vital step towards healing.